- Intrinsic Value Calculator Excel

- Intrinsic Value Calculator Excel File

- Indian Stock Intrinsic Value Calculator Excel

- Intrinsic Value Calculator Excel Download

These tools can help you get a more long-term perspective and become a more disciplined, rational and patient investor. Remember that the intrinsic value calculators are just an estimation of the value of the stock. Do your own research and don’t rely solely on the intrinsic calcultors. Most of the Excel valuation spreadsheets on this page is included in The Warren Buffett Spreadsheet which is an automatic spreadsheet that will give you the intrinsic value calculation in a few seconds for. Dec 10, 2014 What is Intrinsic Value of Share? We see that the price of a share goes up or down. But if we can calculate the real value of a stock that will be very helpful for the investors. In simple terms, the definition of intrinsic value of share is the discounted value that we can take out from a business during the rest of its life. And you can use the exact same Excel spreadsheet I use for calculating a company's intrinsic value. Download Britt's Intrinsic Value Spreadsheet (temporarily disabled) Just replace the numbers in the yellow-highlighted cells with your company's numbers, and the spreadsheet will calculate a value titled 'Multiple' on line 29. Warren Buffett Intrinsic Value Calculator. The value of a company or any stock, products etc., that is calculated base on the analysis of the financial statements without considering the market rate is termed as the intrinsic value. Warren Edward Buffett, an American business magnate and investor has published some facts on the intrinsic value. How to Calculate Intrinsic Values of Shares in Excel Using a dividend discount model makes calculating intrinsic value fairly simple.

Intrinsic Value Calculator

Our mission is to help people not to lose money in the Overvalued Stock Market Bubble.

Get it on Google Play

There are more than one way to calculate Intrinsic Value. Each method used will give you different result. The best way to find out an Intrinsic Value is to use few different methods for calculation and analyze the results.

This Intrinsic Value Calculator is based on Warren Buffett's 'Ten Cap Price' otherwise known as 'Owner Earnings'. Warren Buffett is calling Owner Earnings the most 'relevant item for valuation purposes - both for investors in buying stocks and for managers in buying entire businesses.'

Per Warren Buffett's Value Investment Theory the buy decision should be based on several factors:

1. Company must have competitive advantage...

2. Company performed admirably in the past 10 years, recovered after market correction(s) and recession(s)...

3. Company must have long term prospects - be relevant in 10 years from now...

4. Company's market price should be 20-30% less than calculated intrinsic value - margin of safety price.

Intrinsic Value Calculator Excel

The logical question we would ask, is it possible for such a good company to have the market price 20-30% bellow intrinsic value? The answer is: YES! It is possible due to various reasons. Some of the reasons are: bad news about the company, company's industry is out of market favor, market is in correction or recession...

YES, Recession! You can read about our 2019 market analyses by clicking on DIY icon on the bottom of this window. All statistical data show that we are in the next Market Bubble similar to 'DOT-COM Bubble' of 2001 and 'Housing Bubble' of 2008. It is just a matter of time before current Market Bubble is popped presenting an opportunity for Value Investors to buy their favorite stocks for less than intrinsic value! But in order to buy your favorite stocks for less than intrinsic value you need to know what intrinsic value is. This is when our Intrinsic Value Calculator comes handy. You can calculate, store, reload and compare intrinsic value with market price anywhere and anytime, and all you need is your phone and our application.

You can read more about Value Investing online. We would really recommend - 'The Intelligent Investor' by Benjamin Graham - Warren Baffett's favorite teacher and the founder of Value Investment Theory.

The goal of this application is to help investors not only to calculate intrinsic value but also to understand meaning of values and easy way of locating them. Most of the values required for calculation could be found on company's latest annual report. Annual reports can be found on company’s website in investor relations section. Values missing in annual report could be found on GOOGLE.

Each edit field has a corresponding help button to explain the meaning and location of the data on Company's annual report.

'Examples' button would display actual values for Bank of America and all FAANG stocks: Facebook, Apple, Amazon, Netflix and Alphabet’s Google.

To see the result of updated comparison of market price to the intrinsic value you would need to update current market price.

'Save Data' button would save data to your phone storage at 'IntrinsicValueData' folder as comma separated .CSV file.

'Load Saved Data' button would display list of files .CSV saved at 'IntrinsicValueData' folder.

'.CSV' files in 'IntrinsicValueData' folder could be copied to PC and loaded to MSExcel for further analyses.

'.CSV' files modified on MS Excel can be copied back to 'IntrinsicValueData' folder. Try to keep the same format to avoid breaking Intrinsic Value Calculator.

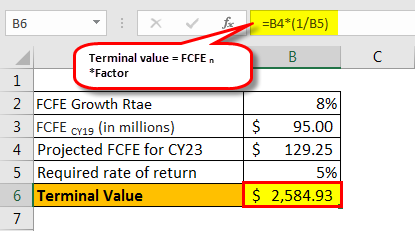

To calculate Intrinsic Value based on Owner Earnings you have to add several numbers found on company's Annual Report: '

1. Net Income

2. Depreciation and Amortization

3. Net Change Accounts Receivable

4. Maintenance Capital Expenditures (should be negative number)

5. Income Tax

Multiply result by 10 and divide by number of shares.

This method doesn’t take growth into account.

Privacy Policy for Android:

This Application requires access to your local storage to save entered data as '.CSV' format and to read saved data.

Intrinsic Value Calculator Excel File

This Application doesn't transmit any data from your phone and doesn't copy any data to your phone from external sources.

This Application requires access to internet to redirect you to 'Recession of 2019 and The Opportunity For Value Investors' article.

Indian Stock Intrinsic Value Calculator Excel

Google Play only:

This Application requires permission to READ_PHONE_STATE and CHECK_LICENSE in order to check for Google Play license.

Get it on Google Play

Intrinsic Value Calculator Excel Download

Get it on Apple App Store

Get it on Amazon

© 2019 Best Implementer LLC

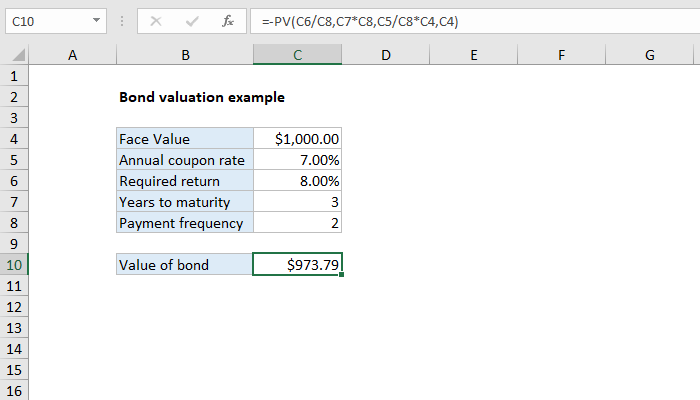

Example-- Let’s say you want to interested to invest in Maruti Suzuki.

The current share price of Maruti is Rs 7463.95(Sept 2018). During the trailing twelve months, the EPS of the company was Rs 260.86.

The first thing you need to do is to find the projected growth. The analysts are saying that Maruti will grow at a rate of 16.56% per annum for the next five years. (Source- Yahoo finance - Go to the stock page and check the ‘Analysis’ tab)

Next step is to find the terminal growth rate. Let’s say that you researched and found out that its terminal growth rate is 2%. Finally, you need to find the return rate. Assume you calculated rate of return using the CAPM model and it turned out to be 10%. Overall, here are the values to be used in the calculations:

- Earnings per share = Rs 260.86

- Return rate (%) = 10%

- Growth rate (%) = 16.56%

- For the period (years) = 5

- Terminal growth rate (%) = 2%

From the above calculations, you will get the intrinsic value of Maruti Suzuki equal to Rs 5997.98.

However, you also need to have a margin of safety on your calculations. After all, the future of any company is unpredictable and these calculations are made on few assumptions. Therefore, let's consider a margin of safety of 15% on the calculated value.

Overall, the intrinsic value per share for Maruti after the margin of safety of 15% is Rs 5098.28. (Quick note: The higher the margin of safety, the safer is the investment.)

As the fair value of the Maruti is lower than the current market price, it may be overvalued right now.